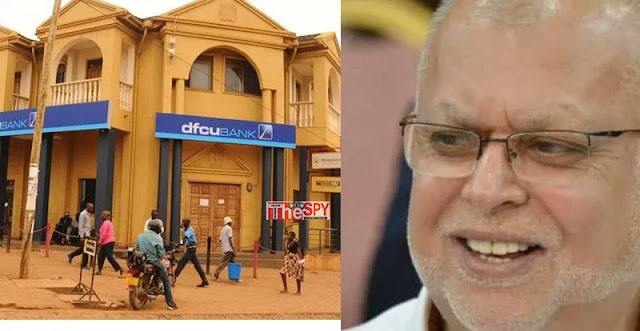

Once a bulwark of stability, DFCU Bank is currently enveloped in a storm of uncertainty and turmoil as the abrupt departure of fifteen important individuals sends tremors through the organization. The echoes of this abrupt departure reverberate through the hallways, leaving a leadership vacuum that jeopardizes the bank's future.

Charles M. Mudiwa, the embattled Managing Director and Chief Executive Officer who was thrown into the whirlwind just seven months ago, is at the wheel. Mudiwa, a Zimbabwean, attempted to establish his dominance despite his colleagues' departure, but his actions are surrounded by uncertainty and conjecture.

This dilemma has its origins in the problematic legacy that Mudiwa took up from his predecessor, Mathias Katamba. DFCU Bank is still plagued by the consequences of its difficult choice to acquire Crane Bank. Since 2017, the institution has been mired in a legal maze that has resulted in substantial losses and heavy fines.

Charles M. Mudiwa, the embattled Managing Director and Chief Executive Officer who was thrown into the whirlwind just seven months ago, is at the wheel. Mudiwa, a Zimbabwean, attempted to establish his dominance despite his colleagues' departure, but his actions are surrounded by uncertainty and conjecture.

This dilemma has its origins in the problematic legacy that Mudiwa took up from his predecessor, Mathias Katamba. DFCU Bank is still plagued by the consequences of its difficult choice to acquire Crane Bank. Since 2017, the institution has been mired in a legal maze that has resulted in substantial losses and heavy fines.

The list of departing

employees resembles a roll call of the bank's principal figures: Godfrey

Mundua, the cornerstone of corporate banking; Ronald Kasasa, the visionary

leader of business banking; Miranda Bageine, the mainstay of personal banking;

and Joan Ntabadde, the luminary leading customer service.

Their departures create a huge vacancy in the bank's leadership and cause anxiety among both stakeholders and employees. However, the administration of DFCU continues to be a fortress unbreakable, defended by a firm silence that heightens anxiety and begs more questions than it answers.

The executives' unwillingness to provide information about the developing problem only heightens the sense of dread by making the organization a poster child for mystery and unsolved questions. As the story progresses, DFCU Bank finds itself in a precarious situation where it must navigate dangerous waters inhabited by the ghosts of Crane Bank's eerie past.

Mudiwa's goals are

threatened by the destabilizing effects of legal entanglements, departures, and

impending uncertainty, which could bring down the very foundations of the

once-reliable financial institution.